The Fed's influence will remain key for Bitcoin in June, predicts 10x Research

10x Research identified U.S. inflation as an important factor for Bitcoin's price

Experts at 10x Research named key macroeconomic factors that could affect Bitcoin's price

Bitcoin is trading 7% below its all-time high in March. For most of May, the cryptocurrency's price remained nearly unchanged, holding above the $67,000–68,000 level. However, between May 27 and June 2, Bitcoin showed increased volatility — first due to the transfer of bitcoins from the bankrupt exchange Mt. Gox, then due to the release of U.S. macroeconomic data and the major hack of the Japanese crypto exchange DMM.

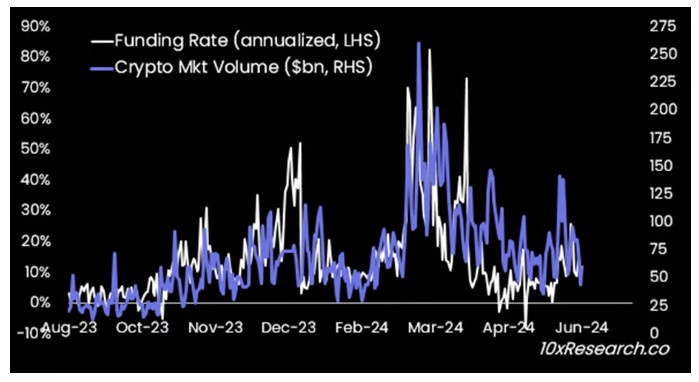

"According to experts, the average daily trading volume does not exceed $50 billion," analysts at 10x Research wrote in their Telegram channel. "Clearly, interest is weak," they added.

BTC funding rate (left side of the chart, white color) vs cryptocurrency trading volumes (right side of the chart, blue color, billion $). Source: 10x Research report

Meanwhile, funding rates, an indicator of payments to traders with open positions in perpetual futures, remain only "slightly positive."

Actions by the U.S. Federal Reserve (Fed) and inflation could become catalysts for new Bitcoin growth. Analysts believe that actions by the Bank of Canada, which may begin a rate-cutting cycle on June 5, could serve as an example for the U.S. Fed.

Additionally, the U.S. Consumer Price Index (CPI), which will be released on June 12, is expected to show a decrease in inflation to 3.3%, which would support Bitcoin's price.

Bitcoin balances on exchanges (green curve). Source: Coinglass

Experts at 10x Research note a significant reduction in Bitcoin reserves on exchanges — in May, 88,000 bitcoins were withdrawn from exchanges, reducing their total volume to 2.5 million, the lowest level since March 2018.

Notably, the outflow of bitcoins from exchanges coincided with the end of the 45-day period during which U.S.-registered investors managing more than $100 million were required to disclose their positions in securities and cryptocurrencies in reports. The reduction in the supply of bitcoins on exchanges could lead to increased demand for the first cryptocurrency.